Fool's Gold: The Impact of Venezuelan Currency Devaluations on Multinational Stock Prices

Dany Bahar, Carlos A. Molina, Miguel A. Santos

Key Findings

- Venezuelan devaluations caused negative CARs of up to 2.07% for MNCs with local subsidiaries, despite Venezuela representing only 0.3% of world GDP

- Effects were driven by firms NOT registered with CADIVI (the currency control agency)—companies that had zero chance of converting profits at official rates

- Markets were repeatedly 'surprised' by foreseeable devaluations over a three-year period, suggesting systematic analyst neglect of country-specific risks

- First paper to apply synthetic control methodology to asset pricing, confirming causal effects of devaluations on MNC stock prices

About This Research

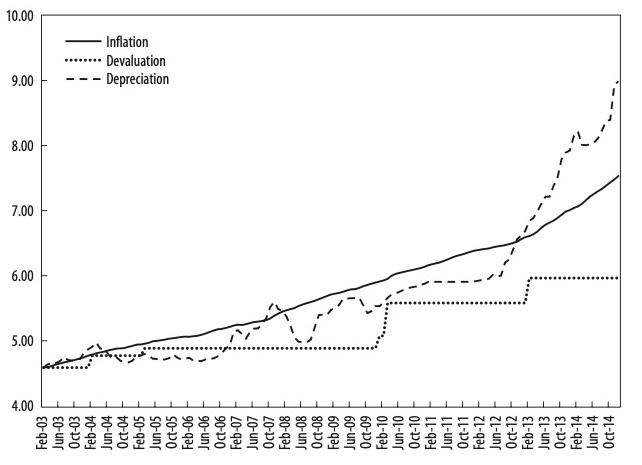

Under the efficient market hypothesis, predictable events should be priced into company valuations in advance. This paper tests this proposition by studying how 110 multinational corporations with Venezuelan subsidiaries responded to five currency devaluations between 2010 and 2014—events that were arguably foreseeable given Venezuela's massive parallel exchange rate premiums and chronic macroeconomic imbalances.

We find statistically and economically significant negative cumulative abnormal returns (CARs) of up to 2.07% over ten-day event windows following devaluations. These results are remarkable given Venezuela's tiny economic footprint (0.3% of world GDP) and the fact that most affected firms weren't even eligible to purchase dollars at official rates. The cumulative losses across all MNCs ranged from $37 to $41 billion—driven by accounting changes to financial statements that had long been divorced from economic reality.

Our results suggest market myopia: analysts repeatedly failed to incorporate foreseeable devaluations into valuations, instead waiting for accounting changes to trigger adjustments. We implement synthetic control methods—the first application to asset pricing—to confirm causality. The findings imply that MNCs operating in countries with exchange controls should be required to include disclosure notes estimating the impact of translating financial statements at all applicable exchange rates.