Refugee Entrepreneurship: The Case of Venezuelans in Colombia

Dany Bahar, Bo Cowgill, Jorge Guzman

Key Findings

- Firms owned by foreigners (primarily Venezuelans) are 10-20% more capitalized at founding compared to locally-owned firms in the same industry and location

- Despite higher capital intensity, foreign-owned firms have the same 2-3 year survival rates as Colombian-owned firms

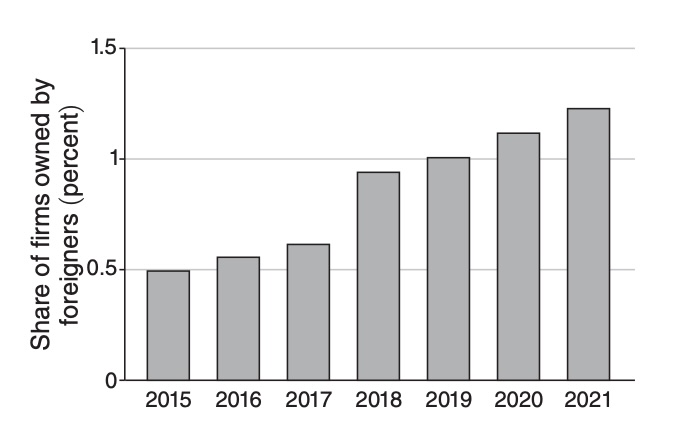

- The share of foreign-owned formal firms in Colombia doubled from 0.5% (2015) to 1.25% (2021), tracking Venezuelan migration

- Foreigners sort into less capital-intensive industries and regions with more limited credit access, such as border areas

About This Research

With 7.1 million Venezuelans fleeing their country—one of the largest displaced populations in the world—this paper examines entrepreneurship patterns among refugees in Colombia, the largest host of Venezuelan migrants. Using the entire Colombian business registry (RUES), we compare firm creation by foreigners to firms created by locals.

We document two main results. First, firms owned by foreigners tend to be 10-20% more capitalized at founding (measured by assets per employee) compared to firms owned by Colombian citizens within the same industry, geographic location, and year. Second, despite being more capital-intensive, foreign-owned firms show similar survival rates—they are just as likely as locally-owned firms to survive two and three years after registration.

The share of firms owned by foreigners more than doubled from 0.5% in 2015 to 1.25% in 2021, matching the massive Venezuelan migration wave. The higher capitalization is consistent with immigrant entrepreneurs showing higher growth performance, possibly due to selection into migration. The similar survival rates despite higher capital intensity may reflect immigrants taking on riskier projects or needing to be more productive simply to achieve the same outcomes as locals.